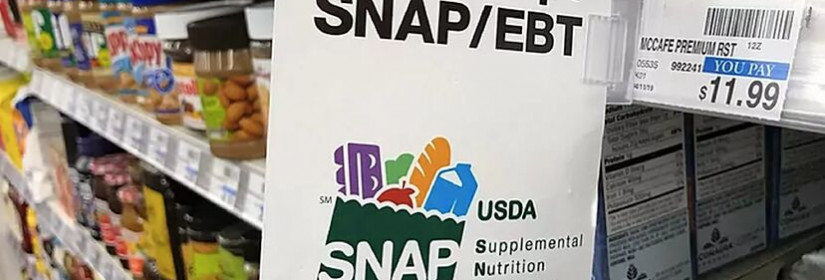

SNAP and WIC Funding at Risk: States Warn Payments May Stop in November if Government Shutdown Continues

Millions of Americans may lose their SNAP food benefits in November 2025 if the federal government shutdown doesn’t end soon.

States like Pennsylvania, New Jersey, Maryland, New York, and Texas have already warned that payments could be delayed or paused.

Related: America’s Food Lifelines: 20 Largest Food Banks Ready to Help Amid November SNAP Uncertainty

Why Benefits Are at Risk

The U.S. Department of Agriculture (USDA) said it will run out of funds for November SNAP payments unless Congress passes a new budget.

Pennsylvania’s Department of Human Services issued a public alert:

"Starting October 16, SNAP [Supplemental Nutrition Assistance Program] benefits will not be paid until the federal government shutdown ends and funds are released to PA."

This announcement has sparked fear among the more than 40 million Americans who depend on SNAP to afford groceries each month.

Who Will Feel It Most

About 73% of SNAP recipients live at or below the poverty line, including children, seniors, and people with disabilities.

Advocates warn many could face tough choices, like paying rent or buying groceries, if benefits stop.

You might be missing out on benefits! Check what’s available to you here.

Can SNAP Be Saved?

The USDA has about $6 billion in contingency funds, but it hasn’t confirmed if it will use them.

In past shutdowns, the agency paid benefits early to avoid disruption, but that hasn’t happened this time.

WIC Program Also at Risk

The WIC program, which helps 6.7 million mothers and children, may also run out of money by November 1.

Temporary White House funds only last through October 31, and an extra $300 million is needed to keep the program running.

What Families Can Do

-

Visit your state’s SNAP or WIC website for updates

-

Contact your local benefits office

-

Find help from local food banks at FeedingAmerica.org

-

Don't miss out on general benefits information!

Subscribe for the latest updates, expert advice, and valuable tips to help you maximize your benefits and financial well-being.

Stay informed—sign up now!